Reduce Forex Costs,

Increase Profits

Myforexeye is helping companies improve profitability by managing bank conversion costs on forex remittances, reducing impact of volatility in forex markets on exports and imports, optimise interest costs on working capital and term loans.

Get in TouchWhy Myforexeye?

How Myforexeye Helps

Companies Improve Profitability:

Optimize Forex Conversion Costs

Manage Forex Volatility Risks

Reduce Interest Costs

Get in touch

Let's Start Your Forex Journey – Connect With Us Today!

Let's connect!

Our Clients

Listen To Our Customers

What are our customers saying?

FLASH ELECTRONICS

We have been associated with Myforexeye for all our forex requirements from exchange rate covering to risk management. Our forex leakages have come down tremendously and we are satisfied with Myforexeye dealers covering the rate for us. Now we can focus on our core business operations for our Flash Group.

Manager Finance & Accounts

KRBL Limited

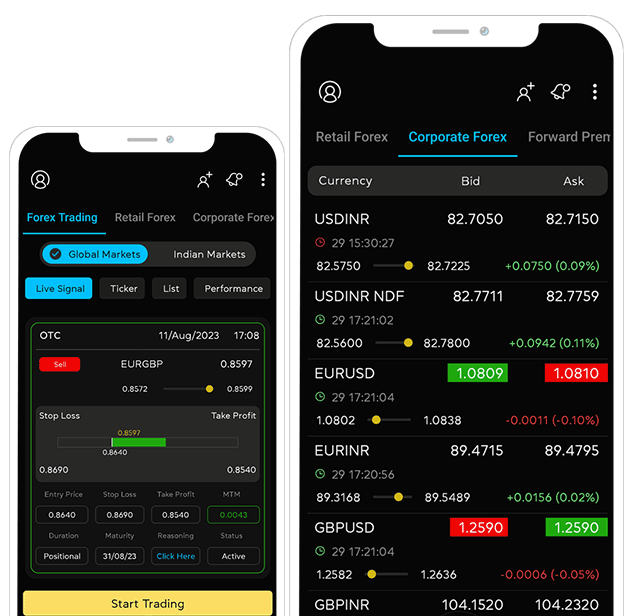

We have large dollar exports and managing forex risk is critical for our overall business profitability. We have collaborated with Myforexeye for forex market intelligence and insights to take prudent and informed decisions. They are associated with us for last 5 years, providing us risk management strategies, market timing and hedge selections. I am quite impressed with their mobile application. It is very well thought through and meets most of our requirements around live rates, forwards, market research and alert functions. It’s a must have application for exporters and importers

Chairman & Managing Director

OPG POWER

Our relationship with Myforexeye has been fruitful and we have been benefitted by reducing our forex cost substantially with the help of Myforexeye professional advices and their knowledge and expertise in forex transactions. They have assisted us in improving our forex risk management systems and streamlined the decision-making process. Forex markets are extremely volatile and it requires constant monitoring of the markets and a well-defined risk management policy - Myforexeye has been extremely efficient in delivering the same

Executive Director

What We Have Achieved Till Now

1,11,500

Total Transactions

$11.8 Billion

Transactions Processed

$170 Million

Total Savings

14,000

No. of Clients Served

Case Studies

Myforexeye helped save 1.03 Lac in a Single transaction through their forex manager.

The client faced forex inefficiencies in Laminates (₹300 Cr imports, ₹100 Cr exports) and Metals (₹220 Cr imports, growing to ₹400 Cr). Missed 4% forward premium led to losses, while hedging imports can improve rates. Switching to import finance cuts borrowing costs by 40 bps, and currency conversion charges dropped from 10-32 paisa to 2 paisa.Value Addition

The client was satisfied with the service of Myforexeye as our dealer serviced the client to save approximately 45 paisa on a transaction of EUR 230,000 that amounted to a saving of INR 103,500.

Solution

Client had recently started using our TPO service and he connected Myforexeye dealer on call to the banker at their Branch. The negotiation started with the bank quoting 78.19 net rate. The banker wasn’t budging until our dealer argued that the premium showing on Reuters screen is different. That is when the banker closed the deal at a net rate of 79.43.

Myforexeye helped me in getting better premium of 4% on Forward market hedging with lower bank margin

The client faced forex inefficiencies in Laminates (₹300 Cr imports, ₹100 Cr exports) and Metals (₹220 Cr imports, growing to ₹400 Cr). Missed 4% forward premium led to losses, while hedging imports can improve rates. Switching to import finance cuts borrowing costs by 40 bps, and currency conversion charges dropped from 10-32 paisa to 2 paisa.1. Currency Conversion charges were reduced to 2 paisa per $ instead of 10-32 paisa paid by the customer with different banks. Myforexeye also identified scope to time the market during the day to maximize realization on receivables and reduce cost of buy FC for payables.

2. . Client was appropriately taking export packing credit as a product of export but since the client wasn’t hedging the exports it was working out to be expensive than PCFC rates. FCNR (B) loans were decently priced at 1.7% per annum but in case client took import finance at LIBOR + 50 bps + 60 bps for SBLC charges then the borrowing could have been reduced by 40 bps. 1. C

3. Hedging Foreign Currency payables and receivables. The client wasn’t utilizing the forward premium of 4% on USD exports. This was a clear leakage. Selective hedge on imports in near future will also help the customer improve FC buying rate